From standalone sites to large networks: The ongoing evolution of clinical research

In a 2019 CRIO eBook, “Scaling and Innovating: The Consolidation and Reinvention of Clinical Research Sites” we explored the emerging trend of clinical research site consolidation. Our predictions were prescient. Today, the number of institutional investors in the space has increased more than 7-fold since 2015, with no sign of abating. We at CRIO predict that this trend will continue, and the consolidation trend that occurred within the medical and CRO industries will happen within the site industry as well.

The rise of the private research site

To complement research done at academic medical centers, many independent research sites started in the 1980’s and 1990’s to offer sponsors alternative sources for enrolling patients. Many were private physician practices branching into research, or free-standing research sites dedicated solely to research, with no provision of medical care. Today, we estimate that 25% of the research sites in the U.S. are freestanding research sites (i.e., with no connection to a health care service).¹

From the 1990’s through the 2010’s, these private research site operations became an integral part of the research landscape. Unlike Academic Medical Centers (AMCs), these businesses are able to start up quickly, work with the sponsor’s central IRB, and often enroll more patients at lower price points. Often located outside of the major urban centers where AMCs cluster, these private sites offer more geographic breadth, allowing sponsors to reach deeper into local communities – a critical access point given the industry’s recent mandate for more diversity.

Site research organizations

There also emerged a business model for “site management organization”, now often rebranded as “trial management organization” or “integrated research organization”. In this model, a professional research site operator partners with physician practices who want to offer research options to their patients but lack the capabilities to do so. These operators install and manage the research staff onsite, while the practice furnishes the patients, real estate and investigators. To sponsors and patients, the research operation appears to be an extension of the physician’s practice, but actually represents a separate legal and operational entity.

Indeed, many trials are bifurcated between what we call “institutional” sites such as AMC’s, major hospitals, and cancer centers, and “private” sites such as physician practices and freestanding sites. Protocols that require access to very specific and more advanced medical conditions such as late stage cancer, surgery, rare disease, or simply advanced forms of chronic conditions often go with institutional sites because they represent centers of excellence to which these patient populations are referred. But for protocols that need access to a broader population base, such as vaccines or everyday chronic conditions frequently managed by PCP’s, sponsors often select mostly private sites because of their faster startup times and superior enrollment.

Overall, we estimate the total market size for investigative sites in the United States is $8 billion, and that private sites represent $3 billion of this.²

The rise of the site network

Starting in 2016, we saw a large increase in the number of institutional investors entering the space by acquiring or investing in new research sites to create multi-site footprints. These investors saw an opportunity to offer sponsors and CRO’s a single point of contact for multiple PI’s and locations, and to standardize and improve best practices in recruiting and operations.

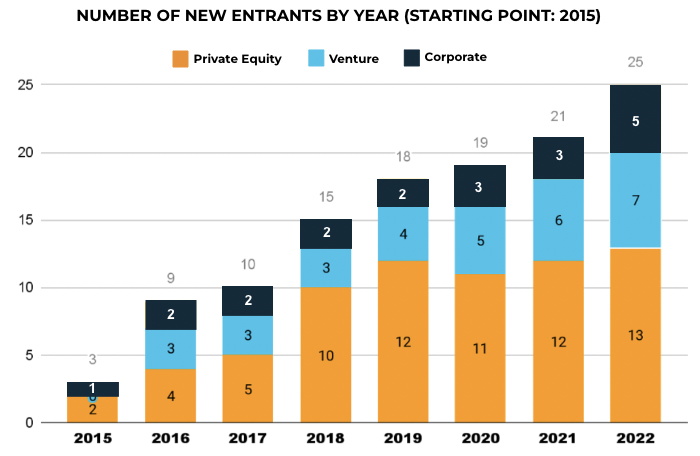

Since then, the industry has seen a large growth in the number of sites operating under a network structure. More investors have entered the market- the below graph shows that as of December 1, 2022, there are now 25 institutional investors in the space, up from only 3 in 2015. In addition, each of these networks is doing their own organic and inorganic growth, acquiring or developing new sites and expanding the throughput at existing sites. As a result, an increasing share of clinical trial subjects are participating in trials run by site networks.

The vaccine trials predicted industry trends

When the world needed a COV19 vaccine quickly, and the sponsors had to recruit huge numbers of patients in a short period of time, the site networks were critical in these trials. Of the U.S.sites on the Pfizer and Moderna COV19 vaccine trials, CRIO classified 49% as major site networks; 23% as independent sites, smaller networks or community practices; and 28% as institutional sites (academic medical centers or hospital-based health systems).

What’s driving this is an underlying business logic. A site network can centralize business development opportunities, placing studies at multiple sites and negotiating contracts and budgets centrally. They can augment local recruiting efforts with central recruitment centers that manage nationwide digital marketing campaigns and utilize call center technology. They can standardize operations using technology, develop a single electronic source template to push to sites, and centraliz and even offshoring EDC entry and other activities.

Site network operating models

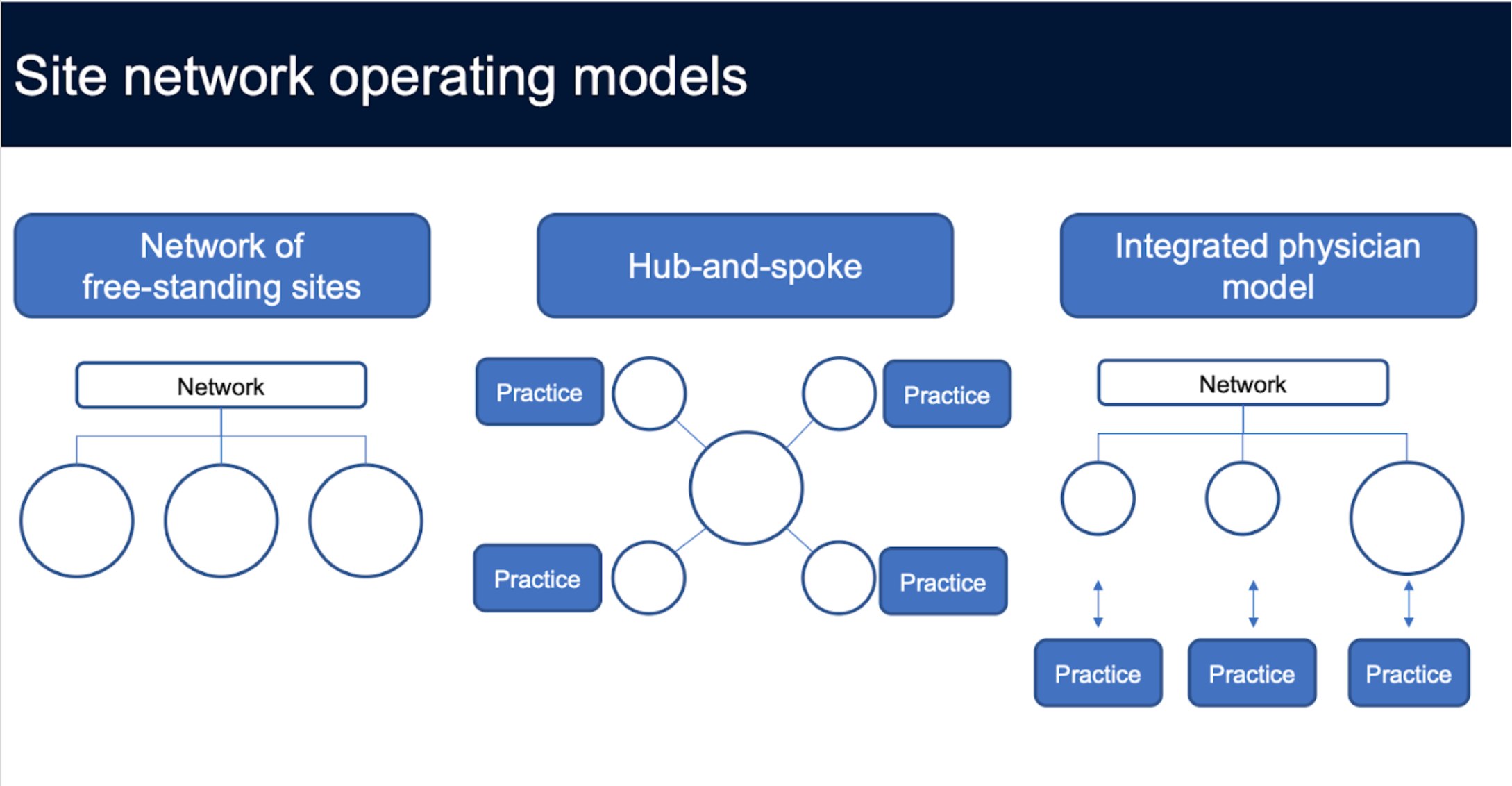

As sponsors require more specialized populations, including access to diverse populations, networks are getting more creative. Rather than rely solely on acquiring larger mature sites, they are investing in greenfield development, striking partnerships with community practices to operationalize research. In fact, there are three broad models of site expansion:

- Large site acquisition: Acquire an established large site. Usually, networks look for sites with at least $2 million in annual revenue. This strategy is the fastest way to scale, but is also expensive, as the competition for high performing sites can be extremely intense.

- Hub and spoke: After establishing a beachhead in a local market, a network can start partnering with local practices, and use their central facility’s scale to house operations and staff roving coordinators. CRIO sees this model a lot with private entrepreneurs, and with technology, this strategy can easily scale.

- Integrated physician model: This is the model of embedding a research coordinator at physician sites, managing them centrally . This approach is a faster way to operationalize multiple locations, but has some risk because of the lack of redundancy at the local level. If the practices are clustered locally, or the site is a large health system, there will be built in redundancy, as coordinators can cross-staff as needed.

The future of clinical research

In the coming years, CRIO predicts that the sites will consolidate the same way physician practices do. Networks will begin to merge and soon we will see global site networks with over $1 billion in valuation emerge. Many independent site operators will align themselves with a network, and others will exit through retirement. Overall, the rise of site networks should bring more professional, standardization, and rigor to clinical trials.

—

Footnotes

- From ACRP survey conducted in Oct-Nov 2022, 25% of 128 research sites surveyed did not utilize Electronic Medical Records software at all in the conduct of trials. This is a good indicator that they source their patients from outside of a physician setting.

- 2021 payments to investigators per Sunshine Act was approx. $7.1B per CMS; however, this excludes payments by companies who do not have approved drugs (i.e., numerous biotechs); also, the U.S. CRO market is generally sized at $16B, and roughly half of that is pass-through of site expenses. Of these sites, we estimate 60% goes to cancer centers and academic medical centers, which are not accessible to private network operators.